New WGR Special Report: “The Sovereign Fund’s Closed Loop Miracle” — Free Download

WGR | The Crossroads Between Global Finance & Financial Literacy

Discover How The Tiny Red Dot Turned Into A Global Financial Powerhouse With This “Closed Loop Miracle”

Protecting Them For Generations, Without Speculation, Risky Bets or Even Complicated Strategies – with simple, timeless principles that helped ‘Money Smart David’ beat The Nobel Prize Winning Goliaths in 1997…

By Walker Global Research

8 October 2025

Does intelligent, mathematical ‘guesswork’ always win?

In 1994, a hedge fund called Long-Term Capital Management was started by some of the smartest men in the world – a team of nobel prize winners, together with the help of big banks, set out to take the world by storm.

They employed dozens of PhDs… had credit lines that came straight from the bank, and for a brief period in history, they seemed to look like the smartest people in the room who ‘knew’ everything.

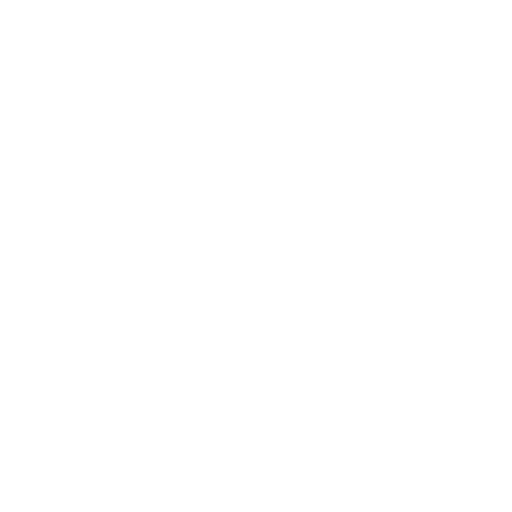

And because of how confident they were in their ‘complicated models’... they took 100 times leverage.

This meant that if you had just $10,000 in savings… they were multiplying that number by a hundred times, and that would mean that your $10,000 in savings would have been worth $10,000,000 on the balance sheets in the markets…

And the best part was that this was profitable for the first few years… leading to them achieving breakthrough returns, that shocked almost everyone…

Using their models, their computers traded billions of dollars worth of positions, trained on just five years of historical data. It seemed nothing could stop these mathematicians from making money hand over fist.

The models said they were safe. The math said spreads would converge. The Nobel Prize winners said the risk was controlled…

Until the asian financial crisis had swept through the world

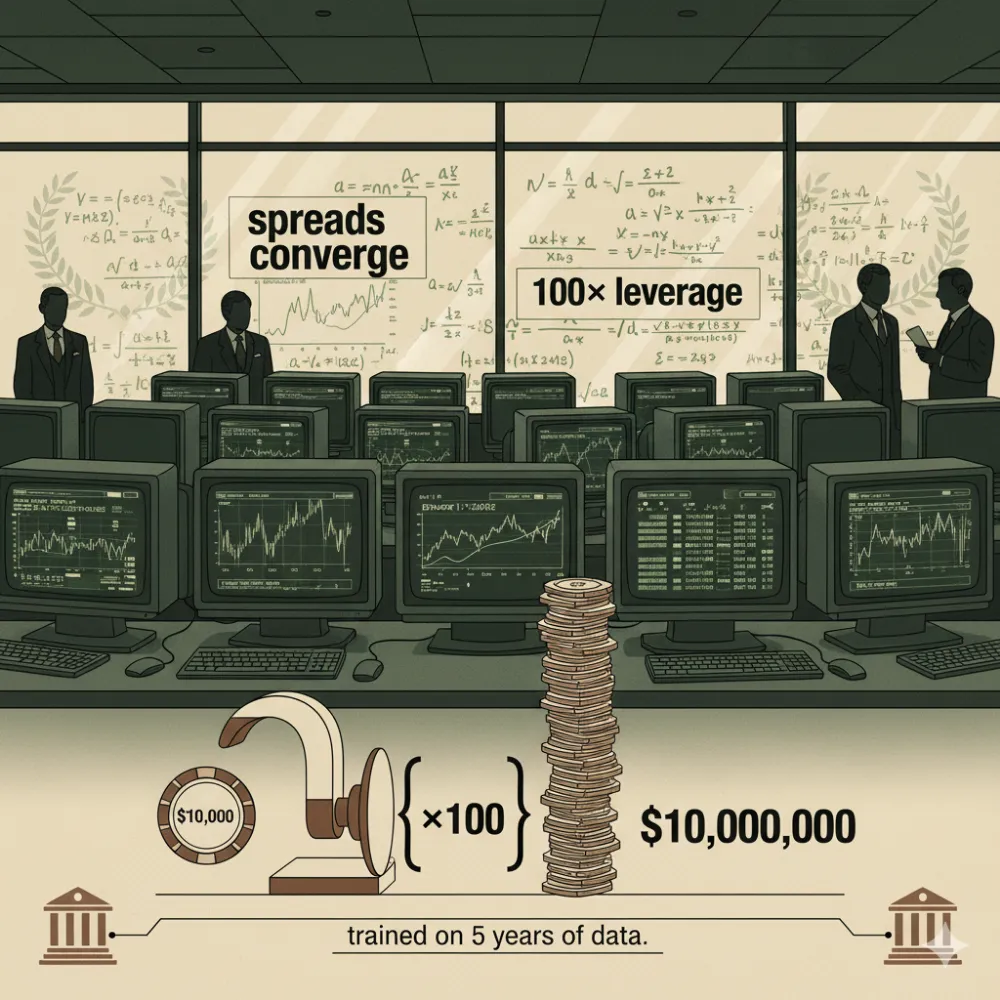

What started in Thailand in July 1997 spread like contagion. Indonesia. South Korea. Malaysia. Currencies collapsed. Markets cratered. By August 1998, Russia defaulted on its debt…

And suddenly, every assumption in LTCM's models broke at the same time…

The "impossible" happened: their models predicted this kind of loss would occur once every several trillion years. An 8.3 standard deviation event– and this was true…

Because they had only trained their models on the past 5 years of data… and in that ‘tiny slice’ of time, it seemed that they had ‘cracked’ the secret to doing well…

And in just a few short months… LTCM had lost close to everything. In August 1998 alone, 44% of the fund's value was gone. By September, the fund had lost over 90% of its equity capital - dropping from $4.7 billion at the start of the year to around $400 million…

Which basically means that your hard earned savings of $10,000, would turn into a tiny $1000 – with almost no way to recover.

Because they had only trained their models on the past 5 years of data… and in that ‘tiny slice’ of time, it seemed that they had ‘cracked’ the secret to doing well…

And in just a few short months… LTCM had lost close to everything. In August 1998 alone, 44% of the fund's value was gone. By September, the fund had lost over 90% of its equity capital - dropping from $4.7 billion at the start of the year to around $400 million…

Which basically means that your hard earned savings of $10,000, would turn into a tiny $1000 – with almost no way to recover.

The asian financial crisis

While LTCM had lost all their money, The Asian Financial Crisis was just as punishing for countries close to home...

This “closed loop” financial system

Had Created An Economic Miracle That Was Able To Survive Even When It Seemed That All Hope Was Lost…

It survived and now this “Closed Loop System” became the bedrock that had survived this brutal crash which seemed to have wiped everyone out.

Without this “Closed Loop” Financial System – countries were experiencing were losing over $100~500 billion dollars in GDP loss… with the value of every dollar in their bank accounts eroding by up to 80% in the worst cases.

This means that if you were to buy things overseas– it would cost you FOUR TIMES as much to get anything into your country… which means that rice that you buy from other countries, costing $2.95… would jump up to close to $10. Medicine from Europe that was $50 could go up to $200…

If you had $10,000 in savings, it could now only buy what $2,000 used to buy internationally.

And you're tired of learning from people who have never spent a day properly understanding what finance is... giving you half-formed advice on a concept they'd just learned...

And you're happy to start getting timeless lessons from History, Finance, and The World of Money...

With rich, memorable, and clear historical examples that can completely change the way that you see money... allowing you to harness money as a powerful tool that can be used to create a nation from nothing...

And to apply the same lessons that these institutions have used to safekeep trillions of dollars...

Without feeling like you're getting 'watered down' quick tips that only make you feel safe, but never truly give you any real insight...

Then, I'd like you to pay special attention to this special report that Walker Global Research has prepared just for wiser people like you...

It's called "The Sovereign Fund's Closed Loop Miracle" made completely FREE for you, as part of our initiative to tell you the hidden stories that are running global finance...

In This Report

Get Your Free Report

Download our exclusive analysis on the Closed Loop Miracle

Now if you’re ready to truly hear how money talks…

and you’re tired of learning from people who have never spent a day properly understanding what finance is… giving you half-formed advice on a concept they’d just learned…

And you're happy to start getting timeless lessons from History, Finance, and The World of Money...

With rich, memorable, and clear historical examples that can completely change the way that you see money... allowing you to harness money as a powerful tool that can be used to create a nation from nothing...

And to apply the same lessons that these institutions have used to safekeep trillions of dollars...

Without feeling like you're getting 'watered down' quick tips that only make you feel safe, but never truly give you any real insight...

What You're TIRED Of:

Watered down quick tips that only make you feel safe

Advice that never truly gives you any real insight

Surface-level knowledge from unqualified sources

Half-formed advice on newly learned concepts

What You'll Get Instead:

Timeless lessons from History, Finance, and The World of Money

Rich, memorable historical examples that change how you see money

Learn to harness money as a powerful tool to build nations

Apply institutional lessons used to safeguard trillions

Then, I'd like you to pay special attention to this special report that Walker Global Research has prepared just for wiser people like you...

It's called "The Sovereign Fund's Closed Loop Miracle" made completely FREE for you, as part of our initiative to tell you the hidden stories that are running global finance...

The sovereign fund's closed loop miracle

Discover how Singapore's financial system survived

the 1997 crisis when Nobel Prize winners failed

Simple principles that beat complex financial models

The "Closed Loop" system that protected Singapore

Learn timeless financial strategies that withstand market crises

Apply sovereign wealth fund principles to your personal finances

Protect your savings from market volatility and economic shocks

Download* your free report now!

Get exclusive insights into how Singapore's financial system survived the Asian Financial Crisis when LTCM's Nobel Prize-winning models failed.

*(Only Qualified AND Vetted Individuals Will Gain Access. We Reserve The Full Rights To Reject & Delete Incomplete or Unsuitable Applications)

Your privacy is important to us. We never share your information.

The amazing recovery story

You see what makes this little red dot's recovery so amazing isn't just the fact that they survived a massive 1997 shock... and neither is it also the fact that they were able to outlast Nobel prize winners...

What's interesting was how they were able to:

Create Accessible Housing

Create a financial system that allows millions to access housing...

Independent Financial Solution

Unexpected costs hurt your budget — and your trust.

Practical & Innovative

Yet created something so practical – that goes beyond just 'traditional' compounding and leaving things in the market...

All while creating a competitive advantage that allows your finances to help you to stay ahead of your career– and to reach the financial targets that you’re looking to hit, whether it’s your first HDB…

financing your education… or having the right systems to create your own financial portfolio that does the work for you…

Inside the free report

In this free report – written by our team of analysts at Walker Global…

We help you to boil down the most essential principles that can change your life starting today… allowing you to open your eyes as to what it really looks like inside these SWFs (Sovereign Wealth Funds)...

Just imagine how you would feel if you were able to stand on the shoulders of these giants… and to see how they oversaw their investments into emerging technologies…

The kinds of conversations that they had on the ground floor of finance…

The worries that they had – and the things that keep even the most ‘seasoned’ portfolio managers up at night…

What we’re offering you here– is a sneak peak behind the curtain of global finance… and a slice of what it’s like to think like them and to see the world in a way that can protect, preserve, and grow your capital consistently throughout all of the different weathers that might come…

And in this report

we cover the exact details that led up to “The Closed Loop Miracle”, and the insights that can help you to…

Take complete control of your financial life

Find ways to not just save – but actually understand the reasons behind each of your financial decisions

Discover opportunities in your own spending patterns, habits – and your own personal life where you can gain more returns…

And get a sense of what the pressures that a day to day portfolio manager might face – as they manage billions of dollars, and oversee investments that hold up millions of lives…

With this you'll be able to open your eyes to a brand new world of history and finance – stripping away all of the 'half-truths' that you've been told about the 'market'...

And finally get a deep sense of the structure, and the hidden strings that are pushing billions of dollars through the market…

So that you finally hear how money is talking in your life.